Czech businesses are “digitalizing” accounting with Excel even though AI can handle invoices better

In Czechia, there is no tool that would help regular companies to digitalize the entire accounting process

Over the past few years, there have been intense discussions about the digitalization of accounting processes. However, the majority of small and medium-sized businesses (SMBs), which make up roughly 156,000 in the market, still haven't undergone digitalization. Why is that? Very few companies conduct detailed calculations to determine the actual costs of accounting. They don't know how much they could save by digitizing. It's not just about paying accountants; there are also administrative costs associated with preparing documents for accountants, managing them (usually in Excel), managerial time, and hidden costs related to printing and storage. The total cost of processing one invoice can range up to around 20 GBP. In addition, there are postage costs or the cost of recovering lost documents.

Don't believe it? Calculate your invoice processing costs with our ROI calculator.

Another limitation is the time and financial requirements of the digitalization process. Available tools on the market and the prices for licenses of such systems, their implementation, and integration into processes can cost a company around 34,000 GBP, which is unrealistic for an average business. The company is forced to hire IT specialists or use its own employees to perform the implementation and integration into existing systems or connection to the accounting system. On average, this takes several long months of fine-tuning, eventually leaving you working in four applications because each can handle only part of the process.

This entire process is an impractical investment for an average Czech company. "Small and medium-sized businesses are completely excluded from automating accounting and have no choice but to stick with an outdated and ineffective manual work model. Their solution involves using Excel; however, there is a complete lack of a tool in the market that would simplify their business by digitizing accounting from A to Z. At the same time, SMBs are not an insignificant segment, with the market size reaching 289,000,000 GBP," says Prof. Drahomíra Pavelková, Director of the Department of Finance and Accounting at Tomas Bata University in Zlín."

What's the process of accounting in the 21st century like in most Czech companies?

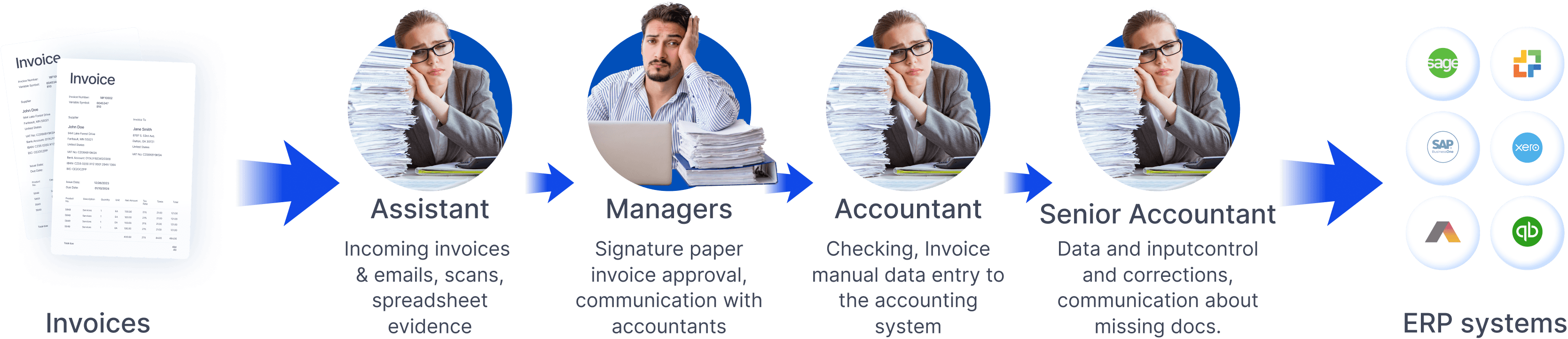

In addition, according to Karin Fuentes, who founded Digitoo with a vision to bring such a solution, the available applications focus primarily on automating the transcription of data from a paper invoice into the system, while completely ignoring other parts of the process. Just before that, for example, it's hours of mail sorting and scanning. "In the 13 years I spent as an accountant, I saw the same scenario – most accountants or trainees spent 80% of their time transcribing data from invoices to accounting systems or behind a scanner," she says. No tool has yet solved this wasted time of workers. At the same time, a normal company needs to digitalize the entire accounting process from the moment the invoice is created until it lands in the customer's accounting system.

The invoice typically goes through an average of up to 8 people before it reaches the accounting system.

The accounting system of the 21st century is finally available

Aware of the missing solutions on the market, former accountant and IT analyst Karin Fuentes, along with her team, founded Digitoo. The application handles the sending of invoices in the form of electronic documents and in the correct format (the format depends on further invoice processing). Artificial intelligence then reads the documents and prepares them for the accountant's review. "Digitoo learns to record alongside the client, so we can already assign any orders, codes, or other data that accountants would otherwise have to enter manually," says Karin. "Manual transcription has been eliminated, and accountants no longer need to call to obtain missing documents," adds Ivan Fučík, a partner at Grant Thornton.

Read more about how the Digitoo application works in the article.

The next logical step in the digitalization of small and medium-sized businesses will be the ability to make payments directly from the application. There will be no need to copy data into online banking or travel to the bank. Direct connectivity with the flow of money is also essential for reporting. Most companies in the small and medium-sized business segment handle this issue with their own complex reports. "Every CEO needs to know, on a daily or weekly basis, how much they are earning, how much they are spending, what their income is, and when the money will run out. At the same time, you need this information for sound company management immediately, not in half a year when you see the results in accounting," says Karin from Digitoo, which generates reports automatically.

AI will be the new accountant, human accountants will be promoted to analysts and managers

The near future of accounting then rests on artificial intelligence, which will not only read and prepare invoice data but also account for itself. "For everything to work perfectly, it is necessary to achieve 90% accuracy of the neural network 90%. Currently, we are reading 70% of invoices in Czech, which already means a significant simplification of work,” explains the founder of Digitoo.

The change will bring new requirements for accounting talent. In addition, software such as Digitoo can solve one of the limits to the growth of companies – the lack of qualified accounting force. Accountants themselves will not lose their jobs, on the contrary. While today, according to an ACCA study, 89% of accountants agree that digital skills are important for their work, 81% of them master only Excel at a professional level. Employees in accounting and controlling will be able to use artificial intelligence, which will fine-tune routine work, and engage in more important tasks such as optimizing tax obligations, reporting, or accounting for estimated items. At the same time, they will work in an intuitive system in which they can easily find their way around.

Thanks to new technologies and the potential of artificial intelligence, the field of accounting can begin to massively attract a young, passionate generation, as has happened in fintech and other industries, for example.